1. Assume the following sales data for a company:

2022 $1000000

2021 $822250

2020 $ 650000

If 2020 is the base year, what is the percentage increase in sales from 2020 to 2021?

A. 154%

B. 127%

C. 549%

D. 27%

2. Assume the following sales data for a company:

2022 $980000

2021 $806400

2020 $ 640000

If 2020 is the base year, what is the percentage increase in sales from 2020 to 2021?

A. 269%

B. 126%

C. 153%

D. 53%

3. Comparisons of data within a company are an example of the following comparative basis

A. interregional

B. intercompany.

C. industry averages.

D. intracompany.

4. In a common size balance sheet, the 100 percent figure is

A. total property, plant and equipment.

B. total assets.

C. total liabilities.

D. total current assets.

5. Coronado Corporation, Inc. has the following income statement (in millions):

Coronado Corporation, Inc. Income Statement

For the Year Ended December 31, 2021

Net Sales $210

Cost of Goods Sold 126

Gross Profit 84

Operating Expenses 60

Net Income $24

Using vertical analysis, what percentage is assigned to net income?

A. 100%

B. 84%

C. 11%

D. 18%

6. Given the following data for the Crane Company:

Current liabilities $300

Long-term debt 300

Common stock 600

Retained earnings 2400

Total liabilities & stockholders’ equity $3600

How would common stock appear on a common size balance sheet?

A. 9%

B. 59%

C. 17%

D. 19%

7. Coronado Clothing Store had a balance in the Accounts Receivable account of $769000 at the beginning of the year and a balance of $842000 at the end of the year. Net credit sales during the year amounted to $11760300. The average collection period of the accounts receivable in terms of days was

A. 144 days.

B. 50.0 days.

C. 26.1 days.

D. 25.0 days.

8. Oriole Corporation had net credit sales of $13200000 and cost of goods sold of $9440000 for the year. The average inventory for the year amounted to $1475000. The inventory turnover for the year is

A. 6.4 times.

B. 8.9 times.

C. 2.5 times.

D. 1.4times.

9. Sheridan Company reported the following on its income statement:

Income before income taxes $427000

Income tax expense 114000

Net income $313000

An analysis of the income statement revealed that interest expense was $50000. Sheridan Company’s times interest earned was

A. 7.54 times

B. 10.82 times.

C. 9.54 times.

D. 6.26 times.

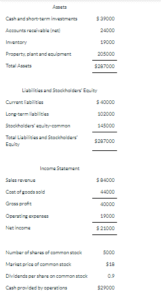

10. The following information pertains to The Crane Boutique Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the current ratio for this company?

A. 2.05

B. 0.8

C. 1.79

D. 0.5